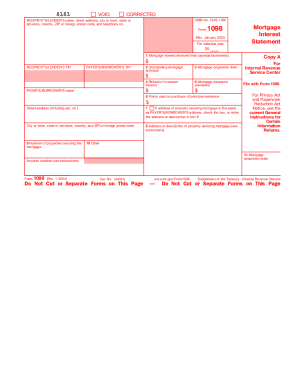

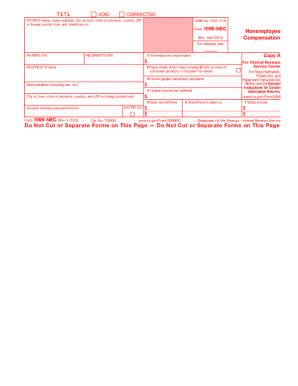

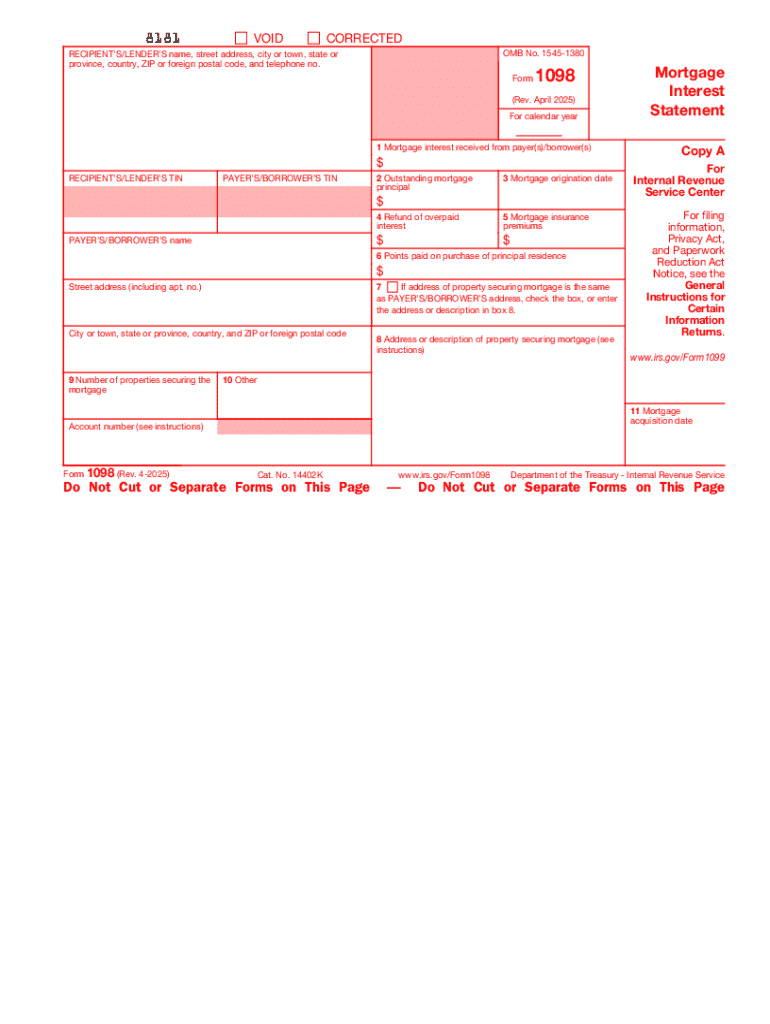

IRS 1098 2025-2026 free printable template

Instructions and Help about IRS 1098

How to edit IRS 1098

How to fill out IRS 1098

Latest updates to IRS 1098

All You Need to Know About IRS 1098

What is IRS 1098?

When am I exempt from filling out this form?

Due date

What payments and purchases are reported?

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

Who needs the form?

Components of the form

How many copies of the form should I complete?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 1098

What should I do if I discover an error after filing my IRS 1098?

If you find a mistake on your IRS 1098 after submission, you can file an amended form to correct the error. Ensure you indicate that the form is a corrected version and include the necessary adjustments so the IRS can update your records accurately.

How can I verify if my IRS 1098 was processed by the IRS?

To confirm the processing status of your IRS 1098, you may contact the IRS directly or use the online tracking options available to filers. Keeping a copy of your submission confirmation can be useful for reference.

What measures should I take to secure the sensitive information on my IRS 1098?

It's crucial to handle your IRS 1098 with care to protect sensitive data. Ensure that any electronic submission employs encryption, and store hard copies in a secure location. Shred documents that are no longer needed to prevent unauthorized access.

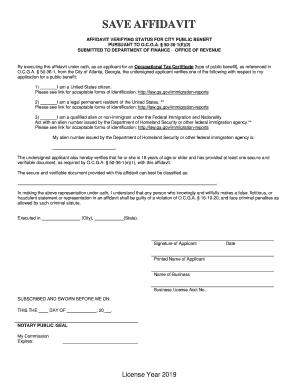

Can a nonresident file an IRS 1098 for a payment received from a U.S. source?

Yes, nonresidents can file an IRS 1098 if they receive payments from U.S. sources. However, they must comply with specific IRS guidelines regarding the reporting of income and may need to furnish additional documentation.

What should I consider if I'm filing an IRS 1098 on behalf of someone else?

When filing an IRS 1098 for another individual, it's important to have the proper power of attorney (POA) documentation in place. Ensure that you comply with any relevant IRS rules to avoid complications with the filing process.

See what our users say