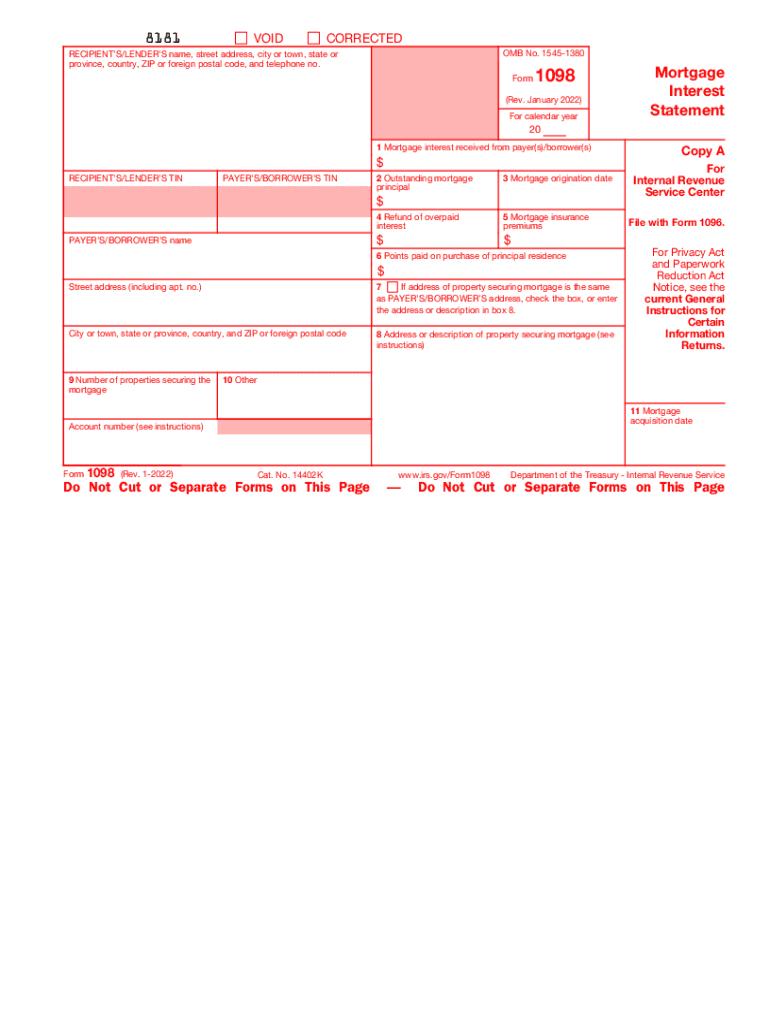

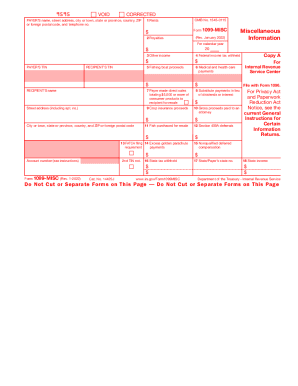

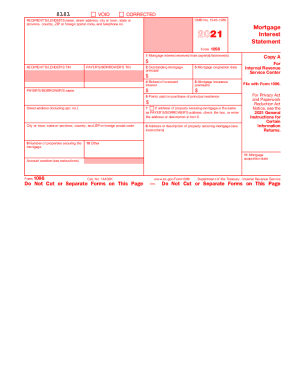

What is the IRS Form 1098 2023?

The 1098 Form is the Mortgage Interest Statement. This form is an IRS information return prepared by mortgage lenders and issued to mortgage borrowers. The form reports various information relating to the lender, the borrower, and the mortgage. Typically, if property taxes are paid through escrow, property taxes paid during the year will also be reflected on Form 1098.

Who needs to file Form 1098 (mortgage interest statement) 2023?

File the 1098 Form if you are engaged in a trade or business and, in the course of such trade or business, you receive from an individual $600 or more of mortgage interest on any one mortgage during the calendar year. You are not required to file this form if the interest is not received in the course of your trade or business. For example, if you hold the mortgage on your former personal residence and the buyer makes mortgage payments to you. In this case, you are not required to file this Property Tax Form 1098.

What information do I need to fill out Form 1098?

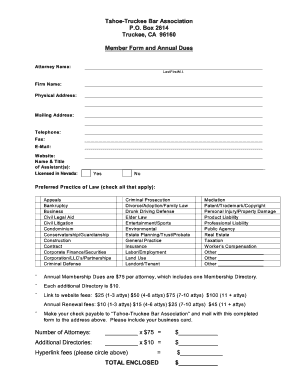

Completing the 1098 form is simple. The left side of the form reflects information relating to the lender and the borrower. The right side of the form (boxes 1-6) reflects information relating to the mortgage interest received from the borrower (Box 1), outstanding mortgage principal as of January 1st (Box 2), mortgage origination date (Box 3), refund of overpaid interest (Box 4), mortgage insurance premiums (Box 5), and points paid on the purchase of principal residence (Box 6). Boxes 7-9 relate to the property and the address that is securing the mortgage.

How do I fill out Form 1098 online in 2024?

Copy A (appears in red) of an electronic version of the 1098 form is not scannable and is for informational purposes. You may fill out copies B and C of the document online. Here’s how you can fill out the mortgage interest statement form online with pdfFiller:

- Click Get Form to get started.

- Open Form 1098 in the editor and review the instructions.

- Click on the required field and enter your information.

- Click DONE when the form is complete.

After completing your mortgage interest statement, select what you would like to do next by choosing any available delivery or saving options.

What other documents must accompany the 1098 Form?

There are three copies of the mortgage interest statement, copies A, B, and C. Copy A of the form is submitted to the IRS. Copy B of the form is issued to the payer/borrower, and copy C of the form is for the lender’s records. Form 1098 has to be accompanied by Form 1096, which is a transmittal form.

When is the IRS Form 1098 due?

- The copy B of Form 1098 must be furnished to the payer by the 31st of January 2022.

- Copy A is to be filed with the IRS by the 28th of February 2022 or the 31st of March if filed electronically.

Where do I send Form 1098?

You may not need to submit a 1098 form with your tax return. Copy B of Form 1098 mortgage interest statement form must be provided to the payer, and Copy A of this form must be filed with the IRS.